Our guest today is Saiful Nasir — the founder of CXD Labs, a customer experience and service design consulting company. CXD Labs helps companies understand their customers and find ways to deliver experiences that the customer expects and beyond.

By working with a raft of FinTech companies, Sai and his team have come up with five core principles that can be applied to any other industry as well. And Sai shared these findings with us during an online event. You can watch the recording below or read the transcript.

Contents

Get the basics right

When designing a product or service, there are a lot of things that could potentially go wrong. But in certain industries like healthcare, agritech, fintech, there is no room for mistakes. So getting the basics right is critical.

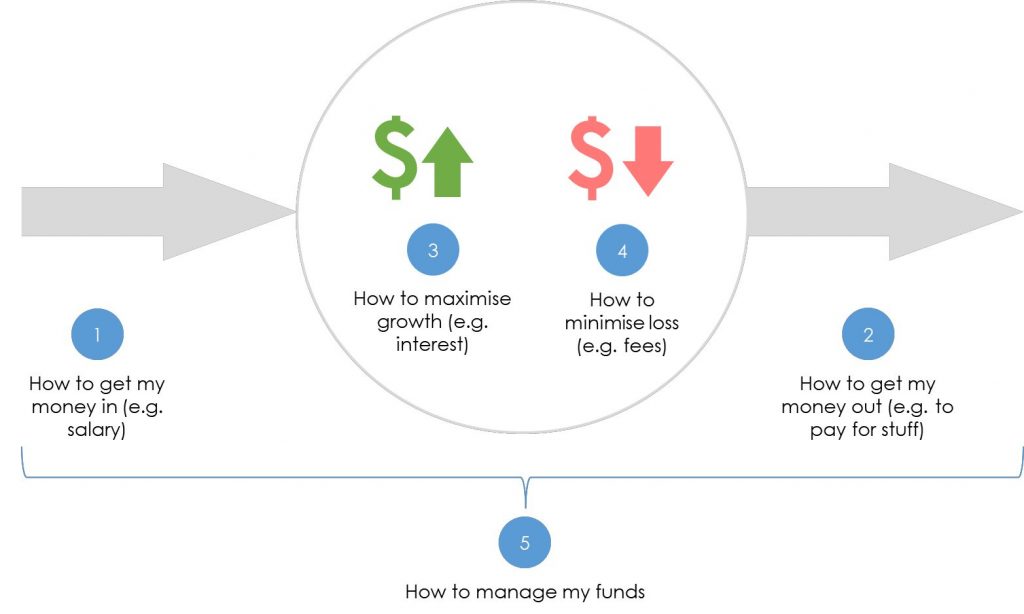

The basics, essentially, are the patterns that become very clear the moment you start unpacking them. Take the financial sector, for example. If you look at FinTech from the customer’s perspective, you’ll be able to see the following five patterns.

So, when a bank has a new product and wants to run it through these five patterns, it’s clear that the bank needs to hit specific pain points. That’s where we can help by improving the product and breaking it down to different features that customers really want in order to get it right.

Once we started to introduce more and more new products, like term savings or personal loans, we ran them through these five patterns and identified which ones fit to ensure that customer experience levels are maintained or improved.

The next step is to engage product development teams and show them what part of a customer journey they are working on when developing a particular feature. This way you can achieve greater synergy between all parties involved, from designers to CJM experts to developers.

Once you get this part done, the next thing you know is that you have a flood of different ideas. And when you put them out on the map, it gets convoluted. So, how do you prioritize?

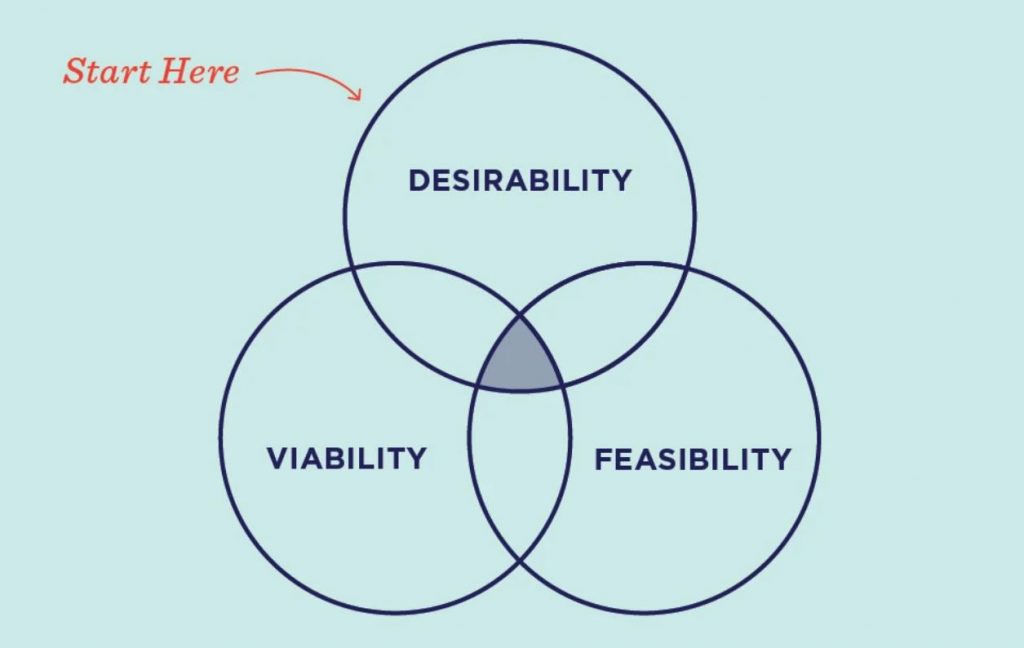

Call out the three lenses

There is a great prioritization tool that can help you sort out the ideas, called three lenses. These lenses are used to focus our attention on what matters the most — desirability, viability, and feasibility.

Start with determining what your customers desire most or what they desire for that particular pattern. Then you need to look at what is actually commercially viable and also technically feasible for you to implement.

In FinTech, brands often push the envelope and work on advancements such as open banking. But when you put it in front of your customers, unless it delivers them benefits they would understand, they wouldn’t care as much as you think they would. That’s why you need to look at it from the customer perspective — what do they desire most? What do they need to solve their problem? Sometimes, even running focus group sessions or monitoring queries to see particular trends is a good start to understand what your customers desire. Once you determine that then you can bring in the business lenses. After all, any company has its profitability goals.

When you marry it all together, you can start to flesh out all the different features with the right balance of customer desirability, technical feasibility, and commercial viability. To simplify the task at hand, you can develop a ranking system for each one of these lenses. And based on what is most desirable out of 10, what is most commercially viable out of 10, what is most technically feasible out of 10, you bring all the right parties along and have a very simple prioritization matrix.

The next principle is a quote that comes in two parts. The first one is:

Treat it like your own money…

FinTech companies are dealing with quite sensitive stuff like personal finances, loans, etc. So, when deciding on the fate of any particular feature, it’s helpful to do the “customer voice in the room” exercise and answer the following questions. Would you pay for it? Would you promote it or recommend it to your friends? Would you protect it if another feature comes along?

As a result, you start fleshing out what solution makes the most common sense. And when you do that and put it on the journey map, the second part of the quote comes in.

...But remember it’s not yours

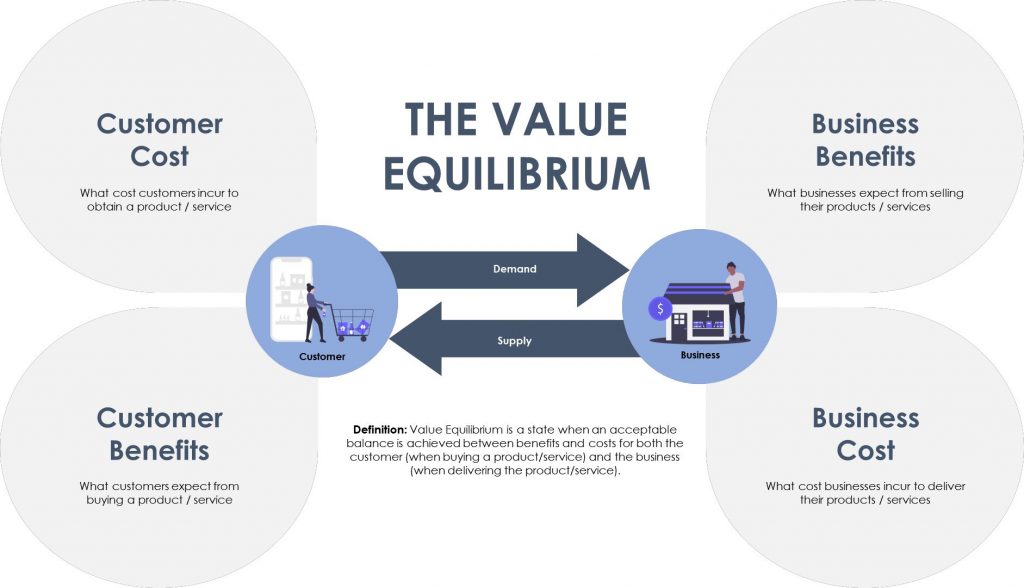

Although you’ve done sanity checks, prioritized features through three lenses, and performed all other steps before, it’s not your money. That’s why you need to do validation.

FinTechs have a great feedback loop mechanism. For that purpose, they have a small group of dedicated users who are early adopters and like to provide feedback as they go along. Sometimes there are also specialist groups. Some of them are part of pattern 1 (how to get money in), some are part of pattern 3 (how do you reduce fees).

The reason for validation is to get a better idea of customer costs versus benefits, what benefits you get as a business, and also what business costs you’ll have to incur. These are the things that you need to get the right balance.

Now that you’ve got into the rhythm of this, comes the hardest part.

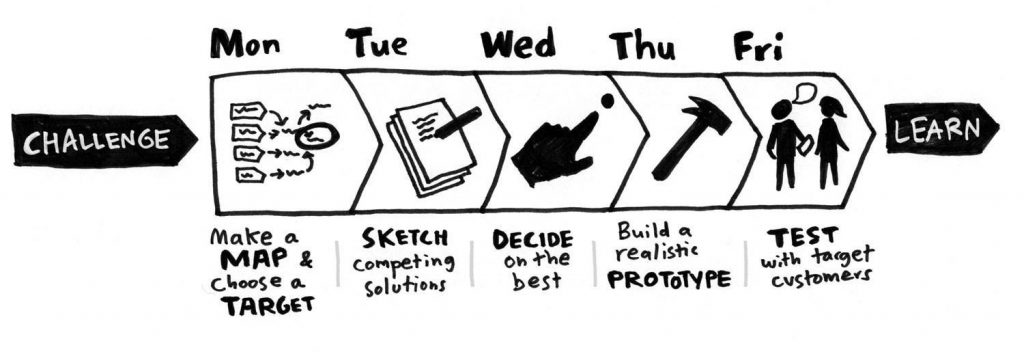

Learn fast

FinTechs are known for a culture of learning fast and moving quickly. One of the best ways to achieve this is to have a designer embedded within the development teams to follow the feature through.

This approach allows for your customer journey map to continuously evolve as the product is being delivered. You can actually look at what improvements have been made and then update your map accordingly. Any shifts in NPS or customer positive feedback about a feature — you can showcase this all on the map, making it a living, breathing document.

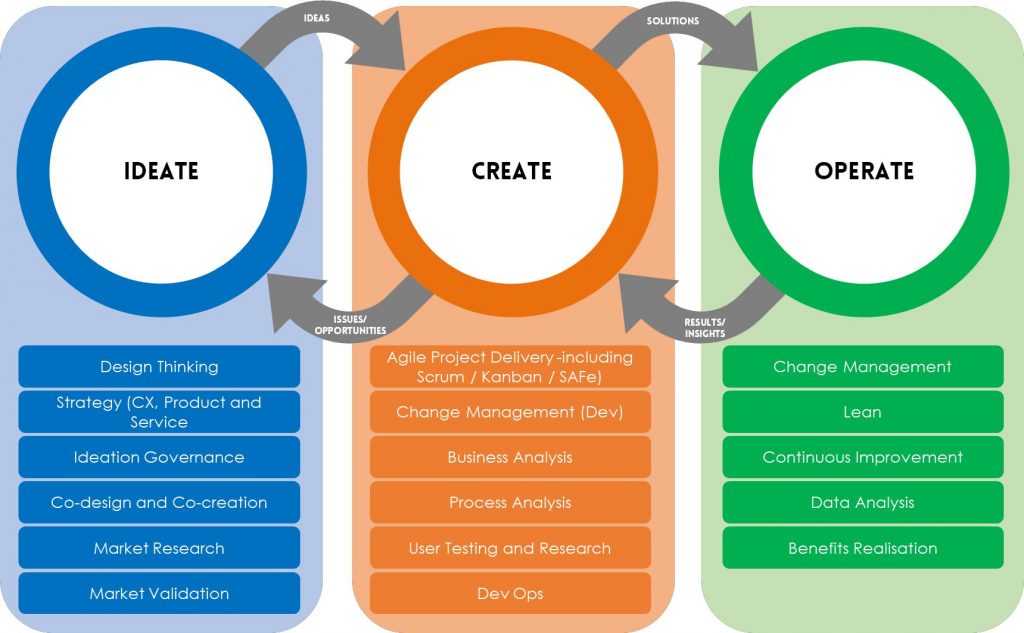

To ensure the “learn fast” approach works, we developed a framework that helped us identify small groups that managed to deliver as part of ideation, creation, and operation processes.

Q&A session

Sai’s talk was followed by the Q&A session, and these are some of the questions and answers that we thought too interesting to keep in the recording only.

How do we do that for complex journeys?

Complex can come in different forms, whether it is multiple channels or a variety of products. But first things first, and “Get the basics right” applies here as well. Then you can go to the next level and perform categorization to find commonalities and do mapping for them. If it’s still problematic, it may be wise to take a step back to see whether you need to simplify the actual process or product because complexity may be caused by the business itself.

How do you deal with different mindsets going through customer journey mapping?

Every voice needs to be heard, but not every voice is important. However, there are mechanisms that you can use to deal with different mindsets without offending people. One such mechanism is a voting system. By applying certain key criteria like desirability, commercial viability, and technical feasibility, you can arrive at an objective decision. Also, if the mindsets are still competing, you can always ask “Is that something that the customers desire?” and bring it back to the customer (something everyone would align to).

How many customer segments did you arrive at or decide to cluster?

Most of our banking customers have two sides to consider: the business-side (B2B) and customer-side (B2C or retail). Segmenting each side depends on the goals of the CJM and what we’re trying to achieve. For example, for business customers, one way to split into segments is by annual revenue and annual sales (and based on that we develop tiers).

The reason why is not to degrade the experience for all tiers, but standardize as much as we can and for tiers that are willing to pay additional, we can cater a different experience for them. And from the consumer side, there is a whole raft of ways to profile the audience. In the past, we have used the MOSAIC model to flesh out personas and then aligned them with the marketing segmentation.

Typically, our client’s Marketing department already have their own customer segmentation that we tend to leverage. However, we tend not to use demographic segmentation and instead focus on behavioral and segmentation, and this can produce a range of segments (no two banking clients are the same).