Transforming a banking experience from disappointment into delight is no easy feat, especially for well-established financial institutions. They often face multiple challenges in dealing with legacy systems, organizational silos, and a compliance-driven environment. So there’s no surprise that banking leaders skeptically approach the idea of making banking clients’ experience delightful.

In this article, I will share an inspiring case study that goes beyond traditional journey mapping and delivers magnificent results for a banking organization.

All kudos to Chantel Botha, founder of BrandLove, who shared this case at our recent online event. She also used a baking analogy to illustrate her point. We all enjoy cakes, but we must follow the recipe to have a good one. The same is crucial for success. So you are up for a recipe for a seamless banking experience.

Contents

- 1 The recording

- 2 Banking experience problem

- 3 Three magical steps to the exciting banking experience

- 4 The results

- 5 Wrapping up

- 6 Bonus: Q&A

- 6.1 Can you give us a tip to measure the implementation of our results or insights with respect to OKRs or KPIs?

- 6.2 Can you review the timeline for the process? How long should you allot for the three steps?

- 6.3 Can you give 3 tips on creating personas for contact centers to create a good CJM for those calling?

- 7 About Chantel, founder of BrandLove

The recording

Even if you are going to read this article (I hope you are 😄), you gotta watch this video because, let me tell you, Chantel is a compelling speaker! Her live performances are full of experience-based details and captivating storytelling:

Banking experience problem

Once upon a time, there was a bank that was highly regarded and known for its innovative practices. They even received awards for being the most innovative bank globally. As time went on, the bank grew in size, acquired more customers, and expanded its range of products and services. However, due to their past successes, they might have become somewhat complacent.

The cracks began appearing as customers felt the bank wasn't delivering its brand promise. Complaints from customers grew, employees were leaving, and the bank's market rating started to decline. The bank was determined to address its declining popularity. Typically, when press releases announce rankings of banks in the land, and a bank drops from second to third place, leaders take notice and realize that immediate action is required.

The team reached out to BrandLove, seeking help to regain their former glory. They wanted to uncover the root causes of their issues and restore their once beloved brand to its shining and popular status in the land.

What happened next?

Three magical steps to the exciting banking experience

Chantel’s team broke down the process into three magical steps:

- Engage;

- Transform;

- Evolve.

And we are going to share each step with you.

Step 1: Engage

losing the gap between leadership and customer viewpoints is vital in large organizations. To achieve this, we can utilize an effective technique called immersion. Let’s explore it through a practical example from Chantel’s experience.

When she started as a customer experience program manager at a major insurance company in 2008, her goal was to show the true essence of customer experience to the company's leaders. To achieve this, Chantel highlighted a pivotal moment in the life insurance journey: the process of filing death claims.

For the sake of a powerful demonstration, Chantel arranged an activity for the executive committee. She asked them to fill out a death claims form, imagining they had recently lost a loved one. To engage them further, Chantel provided colored pins for the participants to mark their responses on the form.

During the activity, the executive committee members had to use red pins and circle any non-customer-centric elements in the form. As they went through the pages, some members requested to stop after reaching the third page. Yet Chantel insisted on continuing as there were still 15 pages left. Sounds like torture? But this exercise gave the bank leaders a firsthand experience of their customers' challenges.

One crucial realization was positioning the broker's name and code at the beginning of the form. The committee questioned why somebody gave it such priority.

After investigating further, they realized that the form was great for the system's data capture process but wasn't customer-friendly. The leaders also felt uneasy whenever they encountered the word "deceased" in the form. Also, the form included technical, difficult-to-understand terms.

Following the meeting, there was a significant shift in the bank leaders’ perspective. They approached Chantel to understand the budget required to fix the issues identified. They also shared real-life cases with the top leadership team. There were financial challenges, but the team remained determined to improve the banking experience.

Within a few years, they launched a banking experience transformation program that resulted in notable improvements across multiple metrics tracked by the bank.

A crucial element in gaining support from leaders was to immerse them in the experience and help them grasp the challenges themselves. People tend to take action when they seek to avoid pain or increase their satisfaction. Yet, executives often become aware of internal issues only when a complaint reaches their attention.

Step 2: Transform

The second phase, also known as "Transform, " encompasses three sub-steps: evaluate, extract, and elevate.

Evaluation

Understanding the customer and employee experience is paramount. However, employees often face a dilemma: their experience is poor, while managers expect them to love the brand. Without empowerment and inspiration, fulfilling this expectation becomes very challenging.

Chantel developed a 10-question checklist that one could complete in just a few minutes. Its questions raised awareness about the bank's customer experience status.

But just as a medical check-up requires more than measuring temperature, we must delve deeper and evaluate both the customer and employee experiences. Assessing the clarity of the brand promise is crucial for a comprehensive understanding of your organization's customer experience health.

Extraction

Once the health check highlights the issues, it becomes crucial to define the core of the brand and its genuine promise. If we ask 10 individuals within your organization about the desired customer experience and receive 10 different answers, it signals a problem.

Many companies have difficulty clearly and consistently defining their vision for customer experience. This lack of clarity makes it hard for employees to deliver the desired banking experience and affects how the customer journey is designed. When there isn't a clear guiding principle, each designer involved in the process will rely on their understanding or information from various sources within the organization.

Journey mapping is a blend of science, art, and magic. It involves defining your goals and the desired emotions you want customers to experience when engaging with you. It's not solely about how customers perceive your brand but also how they feel about themselves during those interactions. In short, understanding the customer experience means recognizing their self-care and feelings.

Personal experiences greatly influence our attraction or avoidance of specific places. If we become angry in a store and don’t want to feel that way again, it's natural to avoid the place that evokes such feelings. That's why extracting the essence of the brand is crucial. To illustrate this, let's use hot sauces as an example. Among the many options, Tabasco stands out as the favorite for many people. If your brand could possess the same level of distinctiveness and clarity as Tabasco, one would instantly recognize it, even without the label, when poured onto food.

In our case study, the bank identified their essence as "happy to help." They fully embraced this essence, weaving it into every facet of their operations. This guiding principle was apparent in their interactions, documents, and journeys. The bank also focused on eliciting two primary customer emotions: feeling valued and confident.

When designing the customer journey, they evaluated each interaction through the lens of these emotions. For instance, they questioned whether complex forms or physical visits aligned with making customers feel valued and confident. And to enhance confidence and value, the bank prioritized respecting customers’ time.

Also, remember that consistency across channels is vital for a seamless experience. A well-defined "true north" for your brand, understood by all, ensures unified efforts in delivering a cohesive customer experience.

Elevation

Elevating a banking experience involves designing journeys that address pain points for both employees and customers. While mapping your customer journey is crucial, considering the employee's role and struggles is equally important. You have to challenge the belief that data is scarce. You can derive valuable insights from social media complaints, frontline employee feedback, and a telephone call analysis. Listening attentively to customers' emotions and behaviors helps unravel mysteries and informs improvements within organizations.

Let’s get back to the case. Throughout the process of elevating the experience, the bank implemented several initiatives:

- Customer journey. A detailed map was designed to identify and address customer pain points.

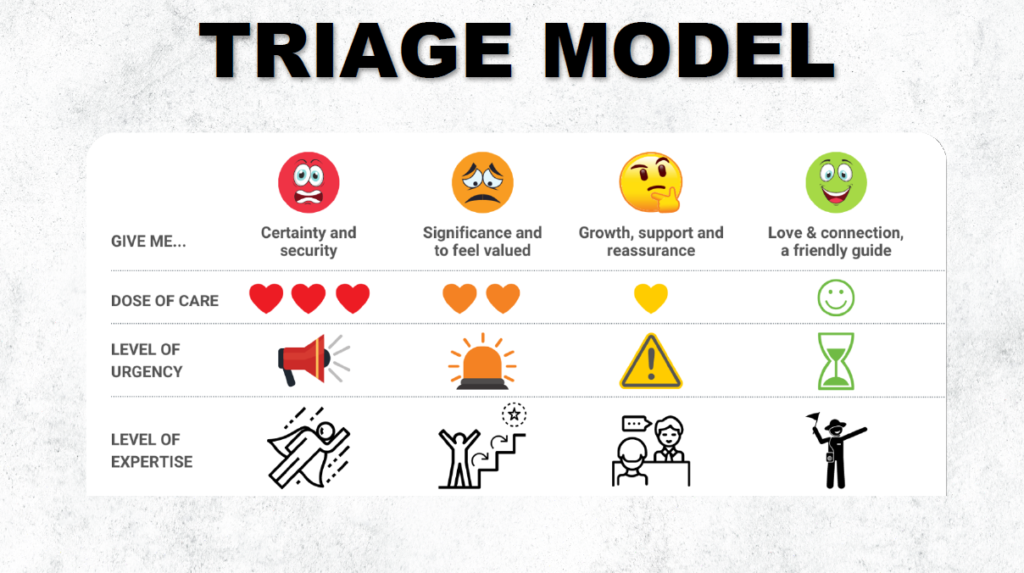

- Triage model. A system was created to prioritize and categorize customer issues based on urgency and severity.

- Conversation guide. A comprehensive guide was developed to assist call center agents in delivering consistent and empathetic customer interactions.

- New KPIs. The bank updated key performance indicators (KPIs) to match the desired banking experience. This change ensured that agents were evaluated based on the most relevant metrics. It was crucial to make this adjustment because agents directly impact employee behavior. When we rely only on commonly used metrics like average handling time, it can lead to rushed interactions and ultimately compromise the customer's experience.

- Brand Warrior Way. It encompassed guidelines and principles for delivering exceptional customer service and effectively representing the brand.

- Implementation plan. As part of the implementation plan, the team created a customer persona named Mandy. Mandy had a negative banking experience, and the team collected voice clips and conducted an interview to share her authentic voice and emotions with the bank's employees. Creating Mandy's persona humanized the customer experience and helped employees understand the impact of their actions on real individuals. It emphasized the importance of empathy and kindness. The company used a fictional name to protect the customer's privacy despite a real customer behind the persona.

Mandy's voice clip was a powerful tool in training sessions and meetings. It reminded everyone of the customer's experience and the need for improvement. Replaying the clip constantly inspired empathy, urgency, and a commitment to enhance the overall banking experience. Thus, designers and decision-makers were motivated to find solutions for Mandy's pain points using their problem-solving skills.

Journey maps

The bank team also created customer journey maps, covering key journeys like Account opening, Complaints, and Care. These visual representations captured the banking experience, focusing on enhancing call center interactions with customers in the journey of care.

By mapping these journeys, they could discover touchpoints, pain points, and opportunities for improvement. However, at times, banking experience journey maps can be too extensive and detailed for employees to peek and quickly find a solution. In such cases, you can create a visual journey model to keep it in front of your staff's eyes.

For instance, the below “journey of care” picture serves as a visual guide for the bank’s call center agents during customer interactions.

The first frame shows a greeting. It often happens that a call center agent hears an annoyed or upset customer, right? In the second frame, we emphasize the importance of understanding our lizard brain. When someone screams at us, our instinct is to fight, flee, or freeze. Then, you proceed to listen. Instead of immediately typing, you listen.

The bank collaborated with customers, call center agents, and numerous groups to develop this journey of care, with careful consideration given to each step.

By presenting the journey as frames, agents can easily comprehend and follow the recommended steps effectively, as pictures can help us sound genuinely natural instead of sounding robotic. That allows us to strike a beautiful balance, ensuring that all compliance requirements are met, such as client authentication, while delivering kindness and warmth.

Triage mode

Now, let's talk about something inspired by the emergency room. Have you ever been to one? When you go, medical staff ask questions to prioritize your care.

For example, if you're having trouble breathing, medical personnel will ensure you get immediate attention. But if you have just a minor accident like cutting your hand with a Japanese knife, you’ll have to wait in the emergency room as it's not something that threatens your life. It is annoying but not a serious situation. Similar to how agents sometimes treat all issues equally without considering their urgency.

But here’s the way out—the triage model concept (the one that BrandLove used in their banking experience case).

When a customer expresses frustration over not receiving their card yet, they may see it as a complaint. However, it's important to recognize that their annoyance is mild and doesn't necessarily require immediate escalation. So it’s a great time to use the triage model that helps agents ask themselves and the client a series of questions to understand the situation better.

If the client falls into the "red" category, the agent's role is to provide them with reassurance, security, and genuine care—like offering three hearts. Depending on the urgency, a higher level of expertise may be needed for a "red" rating. This method helps agents effectively prioritize client interactions. It's a fantastic and practical tool, especially when combined with a conversation guide, which enhances its effectiveness.

Conversation guide

Another tool for the bank was a conversation guide, which had a dual purpose. It helped agents during training to create an effective customer journey and provided explicit instructions on greeting clients and creating a memorable banking experience.

The bank advised their agents to take their time, speak clearly, and show genuine interest. The guide emphasized that these factors could significantly impact the customer's experience, creating a moment of magic or misery. During call evaluations, the guide also helped quality assurance personnel recognize positive interactions and identify opportunities to build loyalty and evoke emotions in the client.

Initially, the company focused on transactional metrics, but they realized the importance of agents genuinely caring for clients, communicating effectively, showing empathy, and building connections. To address this, they made a significant change—allocated 60% of agent measurement to assess care, empathy, and connection.

You may wonder how to measure qualities like empathy objectively. The solution was simple: the quality team identified specific words and cues to listen for. To tackle this challenge, they also defined appropriate responses for different client inquiries, ensuring active listening, accurate reflection, and empathy, especially in challenging situations. While measuring subjective elements can be challenging, evaluating and prioritizing the qualities that truly matter is crucial.

Step 3: Evolve

We have covered two of these transformative steps, and it's time to delve into the final one: evolving. This step is essential yet often overlooked by brands. They may design remarkable customer journeys and even activate them through training initiatives, but there remains a significant aspect of evolving the human operating system.

Frequently, leaders want somebody from the outside to make their people genuinely embody the brand. The reality is that no one can force anyone to do anything. True transformation comes from within individuals themselves.

However, these leaders can have the tools and guidance to inspire and facilitate such an evolution. By implementing the strategies from above, you can create an environment where employees are motivated to embrace brand values, surpass expectations, and truly embody the extraordinary. It's about fostering a culture that empowers individuals to elevate themselves and go beyond the ordinary.

Often, there's an imbalance in resource allocation, with technology receiving more attention than the development and growth of individuals. Yet, we can elevate overall performance by prioritizing aspects like illuminating passion, inspiring purpose, instilling pride, and upgrading skills. That’s what the Brand Warrior Way concept does.

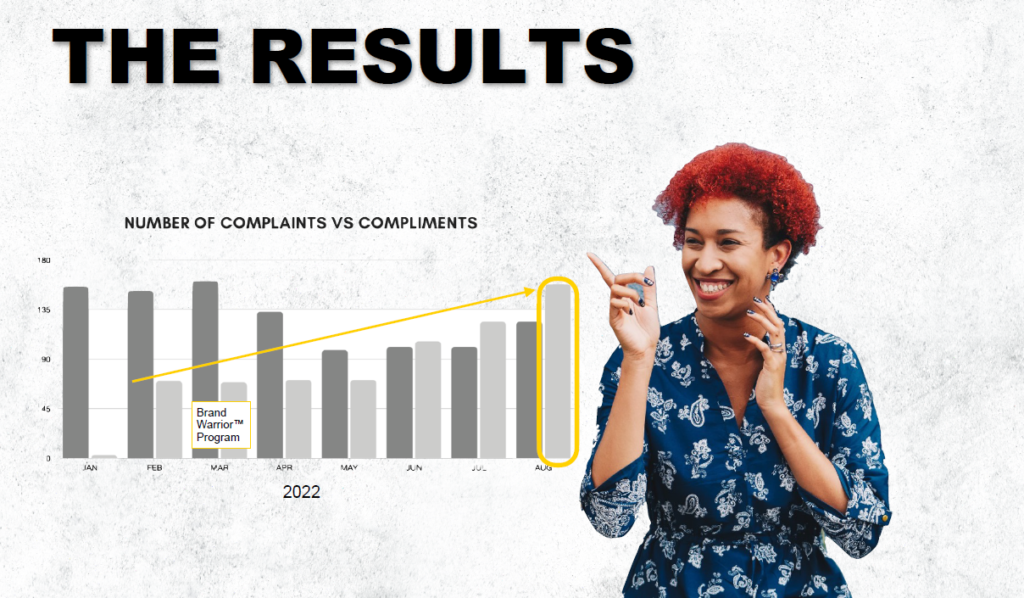

The results

Now, to the results that can make your eyes shine with excitement.

Look at the graph. The yellow ellipse highlights the period from 2020 to 2022. By August, the bank had been on this transformation journey for two years. It's important to remember that it takes time, especially for those working on customer experience transformations. It is particularly evident for large organizations with complex systems and siloed teams.

What's truly fascinating here is the progression the bank made. In 2021, they focused primarily on journey design and crafting the customer experience. Then, in 2022, they embarked on the Brand Warrior Way. This program served as the activation of the journey, upgrading the human operating system and instilling a profound essence: "I'm happy to help, not because you pay me, but because I choose to, and it fills me with pride."

The transformation was impressive, and the graph and results clearly show the impact. It proves that investing in both designing the customer journey and developing the human element can lead to exceptional outcomes.

In addition to personal transformation, the bank also utilized advanced sentiment analysis tools. These tools examined customer calls, enabling the bank to witness a positive emotional shift. Positive sentiments increased while negative sentiments decreased, further validating the program's effectiveness.

Wrapping up

Improving the banking experience can be challenging, and it's normal to feel discouraged. But remember, great things can be accomplished. Just follow these three important steps: involve your leadership, concentrate on the transformation process, and, most importantly, prioritize the development of the human operating system.

Bonus: Q&A

Here's a sneak peek of the Q&A session with Chantel. If you're seeking more questions, answers, and detailed information, you know exactly where to find them—head over to the recording.

Can you give us a tip to measure the implementation of our results or insights with respect to OKRs or KPIs?

One important thing we do is create a CX scorecard. It means deciding in advance which metrics to measure. Common metrics like NPS, CSAT, and effort scores are important, but you may also need to measure things like social media sentiments, lifetime value, or share of wallet. Metrics help us understand which factors have the biggest impact. Creating a scorecard involves different approaches, and discussing all the ROI metrics would require a separate session.

Can you review the timeline for the process? How long should you allot for the three steps?

Many CX teams struggle with credibility, funding, and unrealistic expectations. Transforming customer experience may take 12 to 18 months due to organizational complexities. So leaders must manage expectations, communicate the need for time and resources, and secure executive commitment. Building bridges between silos is more effective than trying to break them down.

Can you give 3 tips on creating personas for contact centers to create a good CJM for those calling?

To create engaging storytelling, the contact center needs a customer persona with dramatic scenarios. You need to highlight impactful experiences, like denied insurance claims leading to hardships. To do that, becoming an expert storyteller is crucial.

Developing a persona for contact center agents is essential too. Make them lovable and add drama to connect with executives. Empower agents to forge strong connections and deliver remarkable experiences by embracing improv techniques for on-the-spot excellence.

About Chantel, founder of BrandLove

Chantel Botha is the author of “The Customer Journey Mapping Field Guide” and the founder of BrandLove. She helps business leaders to empower their teams to live their brand proudly.

She is passionate about closing the gap between what a brand promises and delivers in reality. Employees are often the moment of truth in customers' experiences with a brand. Over the last 15 years, she has perfected the recipe to turn ordinary employees into Brand Warriors.

Impressive banking experience transformation. The results speak for themselves. Kudos to Chantel Botha and BranLove. Now I’m going to watch the recording as there is the full version of the Q&A session. Thanks for sharing!