A pension journey can be full of challenges, from the early days of understanding complicated pension plans to navigating withdrawals in retirement. Poor communication, confusing options, and lack of personalized guidance often frustrate pension savers. These issues can lead to bad financial outcomes, affecting both confidence in the system and long-term financial security.

In this article, we’ll address these pain points by breaking down the critical stages of the consumer pension journey—from enrollment and saving to withdrawals. We’ll also explore different target audience segments, examine the unique experiences of retirement planners at various life stages, and provide practical strategies for improving their customer experiences.

By the end, you’ll understand how to create a smoother, more engaging journey for retirement planners, ensuring they make informed decisions for a secure future.

Contents

The unique challenges of pension customer experience

The consumer pension journey refers to the series of interactions and decisions individuals make from the point they begin planning their retirement to the moment they withdraw their pension benefits and continue managing their financial security post-retirement. This journey is distinct because it spans decades, involves complex decision-making, and affects the long-term financial well-being of pension savers.

The pension journey actively shapes how consumers interact with pension products throughout their lives, from entering the workforce to managing funds in retirement. This journey constantly evolves, driven by personal goals, financial needs, regulatory requirements, and market conditions. For most retirement planners, this path includes planning, contributing, growing funds, and eventually withdrawing them. Each phase reflects changing priorities and engagement as individuals progress through different life stages.

The experience of a pension saver

Unlike other consumer journeys, the retirement journey is long-term and requires ongoing engagement. It is not a one-time decision but a series of touchpoints throughout an individual's life, during which their financial goals and needs evolve.

For example, during their working years, consumers focus on building and growing their pension savings, while in later years, their priority shifts to ensuring that these savings are sufficient to support a comfortable retirement.

Several features characterize this experience:

- Complex decision-making: Consumers must navigate many pension products, investment options, and regulatory requirements. From selecting a pension plan to deciding when to retire, the pension journey is filled with choices that require careful consideration.

- Emotional connection: As pensions closely impact an individual’s long-term financial security, the journey often brings emotional challenges. Consumers frequently experience feelings of uncertainty, anxiety, and even overwhelm, particularly as they near retirement.

- Continuous engagement: A pension journey involves long-term engagement. Pension savers may need to adjust their savings, update investment portfolios, or consolidate pension pots over time. This engagement continues post-retirement as individuals manage withdrawals and ensure their funds last.

- Regulatory and market shifts: The pension landscape is subject to frequent regulation and changes in market conditions, which add complexity to the journey. Retirement planners often need to stay informed about new rules, changes to pension age, or shifting economic conditions that could impact their savings.

- Technological support: With the rise of digital platforms, pension savers increasingly rely on online tools and dashboards to track their pension contributions and performance. That has significantly improved transparency and accessibility but requires consumers to stay proactive using these tools.

A pension journey stands out for its high-stakes, emotional nature. Early in their careers, people may not see the value of pension planning, but as retirement approaches, priorities shift dramatically toward securing enough savings. This change means consumers need clear information, ongoing guidance, and personal support to navigate each stage smoothly and confidently.

In the upcoming sections, we’ll break down each stage of this journey, diving into the common challenges pension savers face and how providers can help make the process smoother and more empowering.

Pensioner personas: Who's on the journey?

In the consumer pension journey, personas are actors. Their needs and behaviors shape the entire customer journey. They are not just fictional characters; they represent customer groups with unique goals, challenges, and preferences.

What are the personas in the pension journey?

A persona (or pensioner persona) represents a segment of future retirees, offering insight into their behaviors, pain points, and motivations at various stages of their retirement journey. Whether someone is just starting to save or planning for retirement, personas help pension providers anticipate and respond to the specific needs of these different groups.

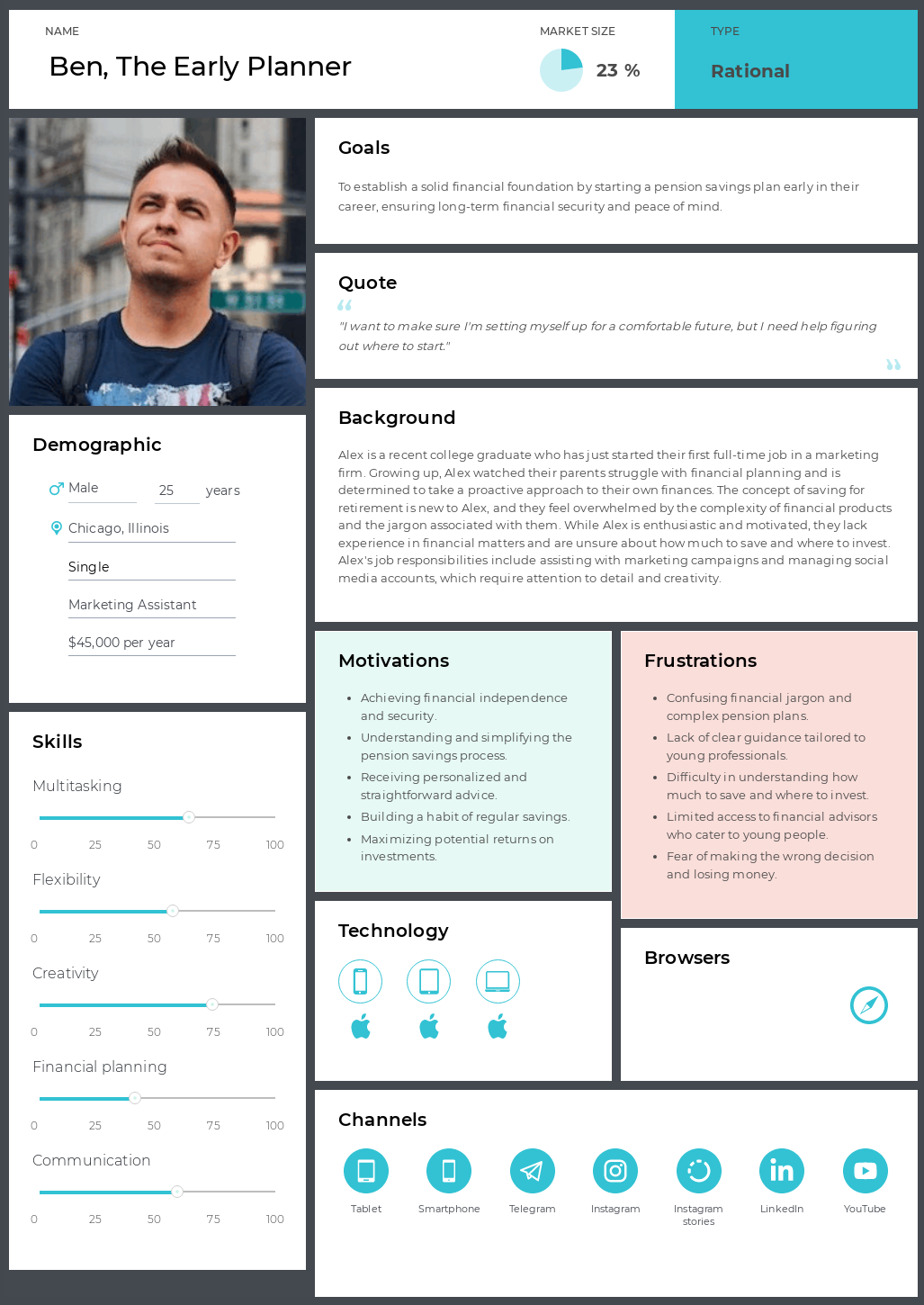

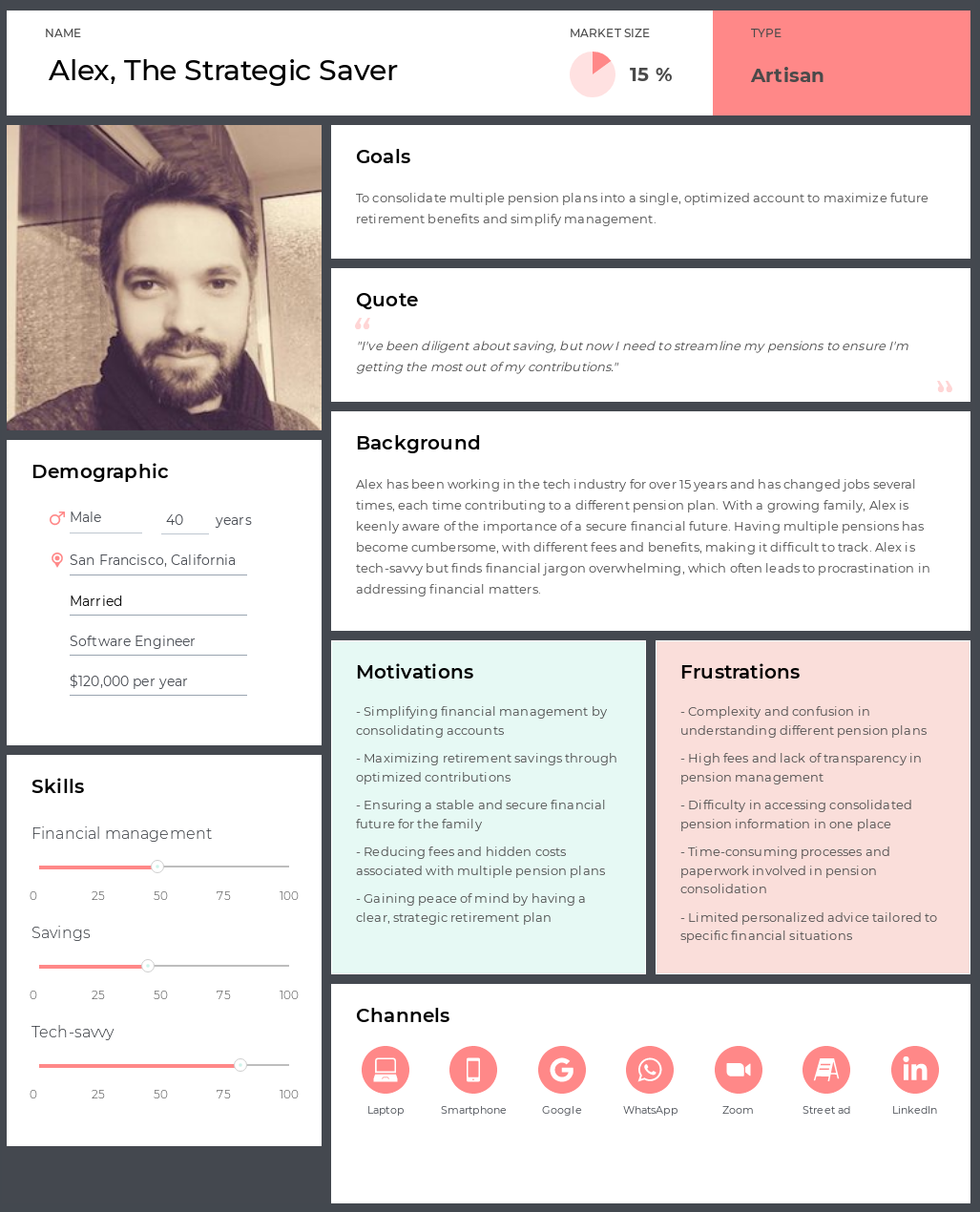

Getting pensioner personas profiles done

When creating pensioner persona profiles, include the details that are relevant to your business or organization. For example, it makes sense to have such sections as Age, Income, Career Stage, Saving Habits, and Preferred Communication Style. This data will give you a full picture of each group’s unique needs. Others include:

- Life stage and goals: Personas reflect where someone is in their pension journey. For instance, a young professional may just be getting started and focused on understanding the basics of saving, while someone nearing retirement is more concerned with how to withdraw their savings sustainably.

- Challenges and pain points: Every persona deals with some challenges. A mid-career saver may be overwhelmed by multiple pension accounts from different employers, while a retiree may worry about making their savings last throughout retirement.

- Behavior and preferences: Personas can explain how consumers prefer interacting with their pension providers. Some might prefer digital self-service tools, while others value more hands-on support from a financial advisor.

To get personas that reflect real people you interact with, combine research with actual data to create meaningful personas. Conduct interviews, surveys, and focus groups with future and existing retirees. Understand their goals, frustrations, and preferences regarding pension planning and retirement.

Use the data to segment pension savers by behavioral traits or other relevant parameters, like saving patterns, investment preferences, financial goals, psychographics, and life events. Make sure to specify each segment's age, income, engagement level, and career stage. This will paint a clear picture of the diverse groups you’re working with and help tailor the pension journey to each saver’s unique needs.

Personas help pension providers create better experiences for their customers. Here’s why they’re so important:

- Personalized communication: By understanding who your customers are and their needs, you can tailor your messaging to be more relevant and effective.

- Improved customer experience: Personas help you identify where your customers struggle and what you can do to make their pension journey smoother and more engaging.

- Better product development: Knowing your customers’ needs allows you to create pension products that meet their goals, whether a flexible contribution plan or an easy-to-use online platform.

- Enhanced service design: Personas guide the design of customer service systems. For instance, younger customers may want mobile apps with real-time updates, while older customers may prefer speaking directly with an advisor.

Examples of personas in the pension insurer customer journey

One of the key industries that benefit from developing detailed personas is the insurance sector, specifically pension insurers. That’s why understanding various customer types enables pension insurers to tailor their guidance and support to match the unique needs of different segments. Here are some basic personas in the pension insurer customer journey:

- The early starter: A 25-year-old who’s just beginning their career and needs clear, straightforward guidance on saving.

- The mid-career saver: A 40-year-old who’s been saving for years but wants advice on consolidating multiple pensions and optimizing contributions.

- The retiree: A 65-year-old who’s focused on managing withdrawals and ensuring their savings last through retirement.

Stages of the consumer pension journey: the path to financial security

The consumer pension journey is a marathon, not a sprint. It extends over decades, encompassing multiple life steps and countless touchpoints—moments when consumers interact with their pension provider, from enrollment and updates to retirement withdrawals. Each stage of this journey is critical, as decisions made early on can significantly impact financial security in retirement.

It's a journey that requires ongoing engagement, continuous decision-making, and regular adjustments to meet evolving life circumstances. Let’s dive into the typical stages of the pension journey, highlighting the complexities and long-term commitment involved.

Stage 1: Enrollment and early contribution

This stage marks the pension journey's beginning, usually when individuals enter the workforce. At this point, future retirees choose a pension provider, select a pension plan, and start contributing. It’s a crucial period that sets the foundation for future savings, yet many young professionals often struggle with understanding the importance of early pension planning.

Example: A 25-year-old starting their first job might be automatically enrolled in a company pension scheme. They may contribute the minimum amount without fully understanding the benefits of compound interest or how increasing contributions early could have a huge impact later in life.

Interactions & channels: Information from employers, pension provider communications, and educational content on the importance of long-term saving.

Stage 2: Accumulation and growth

During the accumulation stage, future retirees contribute regularly, watching their savings grow through investments and compounding interest. This phase can last for decades and is often when individuals revisit their pension plan to increase contributions, change investment strategies, or consolidate multiple pension accounts. It’s also a period where market performance significantly affects how pension pots grow.

Example: A 40-year-old professional might notice they have pension pots with several employers and decide to consolidate those accounts. They may also consider increasing their contributions as they approach retirement.

Interactions & channels: Pension statements, online pension dashboards, interaction with financial advisors, and employer pension updates.

Stage 3: Pre-retirement planning

As individuals approach retirement age, the retirement journey takes on new significance. The focus shifts from accumulation to planning how those hard-earned savings will support them through retirement. Important decisions mark this stage: when to retire, how to withdraw pension savings, and how to manage those funds to ensure they last. Future retirees must also navigate tax implications and the balance between pension products, such as annuities or drawdown schemes.

Example: A 60-year-old nearing retirement might sit with a financial advisor to plan their withdrawal strategy. They may choose between taking a lump sum, purchasing an annuity, or gradually drawing down their pension savings. They’ll also need to estimate their future living expenses and ensure their savings can cover them.

Interactions & channels: Financial planning consultations, pension provider communications about withdrawal options, retirement readiness tools, and seminars on managing retirement income.

Stage 4: Withdrawal and post-retirement management

Once an individual retires, the pension journey enters the withdrawal phase. This phase involves drawing on pension savings to provide an income throughout retirement. The choices in this stage—such as opting for a lump sum or structured withdrawals—can significantly affect financial security in later years. Pension savers must continuously manage their funds, ensuring that withdrawals are sustainable and adjusting plans if necessary.

Example: A retiree might begin with a flexible drawdown plan, allowing them to withdraw varying amounts based on their needs. However, they might reassess their strategy as they age to ensure they do not outlive their savings.

Interactions & channels: Annual pension reviews, financial check-ins, tax planning services, and ongoing management of withdrawal strategies.

Stage 5: Post-retirement support and estate planning

Even after retirement, the pension journey continues with ongoing management and planning. This stage includes monitoring the sustainability of withdrawals, dealing with healthcare costs, and planning to transfer remaining pension savings to beneficiaries. It’s a sensitive phase that may require adjusting previous strategies to accommodate longer life expectancy, health issues, or changes in financial needs.

Example: A 75-year-old retiree may realize they must shift their financial plan to cover unexpected healthcare expenses or consider estate planning to ensure their pension savings can be passed on to their family.

Interactions & channels: Financial advisors, pension provider guidance on estate planning, legal advice for wills, and inheritance planning.

A long and evolving journey

The consumer pension journey is far from a one-time decision. It involves constant evaluation, adjustment, and interaction with various pension touchpoints along the way. Each stage requires different support, guidance, and education levels to ensure future retirees make informed decisions that will provide security in their retirement years.

Pension providers must recognize that this journey doesn’t end with retirement—it requires a long-term approach to customer care and engagement. By understanding these stages and offering tailored support at each one, pension providers can help their customers navigate the complexities of the retirement journey with confidence and ease.

Six ways to improve customer experience

Improving the customer experience for pension savers requires a comprehensive understanding of the long-term nature of the pension journey and addressing the unique needs at different points in time.

Since pension decisions impact individuals' financial futures over several decades, ensuring an excellent customer experience is essential to building trust, engagement, and loyalty. Let’s explore some strategies to enhance the experience for future retirees with real-world examples of companies that are getting it right.

Simplifying enrollment and contribution processes

For future retirees, the first step in their consumer pension journey is often overwhelming. Confusing pension jargon and a lack of clear information can prevent individuals from engaging early.

Nest, a workplace pension provider in the UK, has tackled this by making its enrollment process straightforward and accessible. They offer easy-to-understand guides and calculators that help users visualize how much they should be contributing, simplifying decision-making for beginners. Reducing complexity at this critical interaction ensures that savers feel confident from the very start.

Actionable insight: Provide easy-to-follow enrollment steps with clear, simple language, along with personalized tools to help savers understand their contributions.

Offering personalized guidance

Throughout the pension journey, savers' needs evolve, making personalized support key. Aviva, a global insurer, provides personalized dashboards that allow savers to track their pension performance and receive tailored advice.

These dashboards adjust based on the saver’s stage in the retirement journey—offering suggestions on increasing contributions or adjusting investment portfolios. Integrating artificial intelligence and data analytics enables Aviva to deliver real-time, relevant advice, smoothing the journey at every touchpoint.

Actionable insight: Use data analytics to tailor recommendations based on an individual’s stage in the pension journey, providing advice that evolves with the saver’s changing financial goals.

Providing clear communication on pension options

Understanding the various pension withdrawal options can be confusing, especially as consumers approach retirement. Legal & General, another UK-based pension provider, has implemented a communication strategy focused on clear, concise explanations of annuities, lump-sum withdrawals, and pension drawdowns. They offer easy-to-navigate digital resources and one-on-one consultations to ensure that savers understand their options when making decisions in the final stages of their retirement journey.

Actionable insight: Break down complex pension withdrawal options into simple, digestible information and provide support through multiple channels, including digital platforms and human advisors.

Enhancing digital tools for easier pension management

As future retirees become increasingly tech-savvy, intuitive digital platforms have become a critical channel in the pension journey. PensionBee, a UK-based fintech company, has revolutionized pension management by allowing users to consolidate multiple pension pots into one online dashboard.

Their app provides real-time updates, tracks investment performance, and even estimates a saver's potential retirement income. By integrating everything into one seamless digital experience, PensionBee eliminates much of the frustration of managing pensions across different accounts.

Actionable insight: Invest in digital tools that provide real-time information, simplified tracking, and consolidated views of pension savings to give savers control over their retirement planning.

Proactive customer support and education

Providing proactive support and education at critical touchpoints in the pension journey can significantly improve customer experience. Scottish Widows has implemented a proactive outreach strategy, sending educational materials to future retirees when approaching significant milestones, such as turning 50 or nearing retirement age.

These materials focus on preparing for retirement, reviewing pension contributions, and understanding the tax implications of withdrawals. By engaging customers before they reach a critical decision point, Scottish Widows empowers them to make informed choices, reducing anxiety and confusion.

Actionable insight: Offer proactive support by reaching customers before key milestones providing educational resources that prepare them for the next step in their pension journey.

Encouraging long-term engagement through rewards and gamification

Retaining engagement with future retirees over a long period can be challenging. LV=, a UK-based insurer, introduced a rewards-based system, offering discounts on financial services for savers who regularly contribute to their pension plans or engage with educational content. By gamifying the pension journey, they encourage long-term engagement and ensure that savers stay proactive about their pension planning.

Actionable insight: Consider using rewards or gamification to keep retirement planners engaged throughout their journey, reinforcing positive financial behaviors.

Wrapping up

The consumer pension journey is a long-term, multifaceted path that requires consistent engagement and well-informed decision-making at every stage. From the initial enrollment phase to post-retirement management, the experience can be challenging due to the complexity of pension products, evolving financial needs, and regulatory changes.

To improve the customer experience for retirement planners, providers must focus on simplifying processes, offering personalized support, and enhancing digital tools.

Ready to elevate your consumer pension journey? Start with visualizing it!