Imagine walking into a bank where the air seems to whisper your name, guiding you seamlessly from the entrance to exactly where you need to be. Every service feels tailored just for you, covering your needs before you're even aware of them. Customer experience is the cornerstone of every transaction, every interaction, and every innovation.

In this article, we'll explore three ways the banking sector transforms customer experiences, making every visit, click, or swipe a journey to remember. Get ready to explore how you can meet and exceed the expectations of 21st-century financial services customers.

Contents

What is customer experience in banking?

Customer experience in the banking industry is about how customers feel when they use their bank's services, whether online, on the phone, or in person at a branch. It includes everything from how easy it is to use the banking app to how friendly and helpful the staff is when you call or visit a bank’s branch.

Read also: Banking experience turning complaints into praises

For example, if a bank's app lets you do all your usual banking tasks and gives you personalized tips on saving money based on your spending, you'll likely feel pretty good about using that bank. Or, if every time you walk into your bank, the staff know your name and remember what you need help with, it makes banking feel more personal and less like just another chore.

These examples show that banking isn't just about managing money; it's also about feeling valued and understood by your bank. Banks that get this right don't just keep their customers happy; they turn them into fans who stay loyal and recommend the bank to others, even if there are other banks offering similar services or better deals.

Why does customer experience matter so much?

Customer experience has become the battleground for loyalty, trust, and growth. And here's why it matters so much:

- Differentiation in a competitive market. A superior customer experience can set a bank apart from its competitors in a market where banking products and services are increasingly similar. For example, 24/7 customer service with real people instead of automated responses can be a deciding factor for customers who value direct and personal support.

- Increased revenue. Satisfied customers are more inclined to use additional services offered by their bank, increasing their lifetime value. For example, a customer who is pleased with the mortgage process at their bank might also decide to invest in a savings plan offered by the same institution.

- Customer retention. Retaining customers costs significantly less than acquiring new ones, which makes enhancing customer experience a key strategy in ensuring customer retention. Customers who rate their banking experience highly are likelier to remain with the bank for the long term.

- Word-of-mouth marketing. Happy customers are more likely to recommend their bank to friends and family, acting as free marketing agents. For instance, a customer with a particularly helpful service experience at their local branch might share that story on social media, attracting new customers to the bank.

- Building trust. Trust is crucial in banking, and positive customer experiences reinforce this trust. When customers feel that their bank understands and meets their needs, they are likelier to entrust the bank with more of their financial business.

- Financial well-being and confidence. A bank that provides educational content alongside its services, like budgeting tools in its app, empowers customers to make informed financial decisions. This enhances customer satisfaction and contributes to their overall financial well-being.

In short, banks that focus on improving their customers' experiences win more business and help their customers feel better about their finances. They stand out from the crowd and build strong relationships with their customers, making them the go-to choice for banking needs.

There are plenty of ways to boost the customer experience in banking; let's dive into three.

Way one: Incorporate technology into the banking experience

A digital revolution has transformed the banking world, and today technology plays a starring role in the narrative of modern finance. This transformation is not just about adding new features to existing services; it's about reimagining what banking can be in an era where convenience, speed, and personalization are paramount.

- Ensure your mobile app goes beyond basic transactions. Integrate features like credit tracking and financial coaching, similar to Capital One's "CreditWise." Investing in a robust app not only meets the expectations of tech-savvy customers but also sets you apart as a leader in digital banking services:

This tool leverages big data analytics to provide personalized insights, making users feel like they have a financial coach in their pocket.

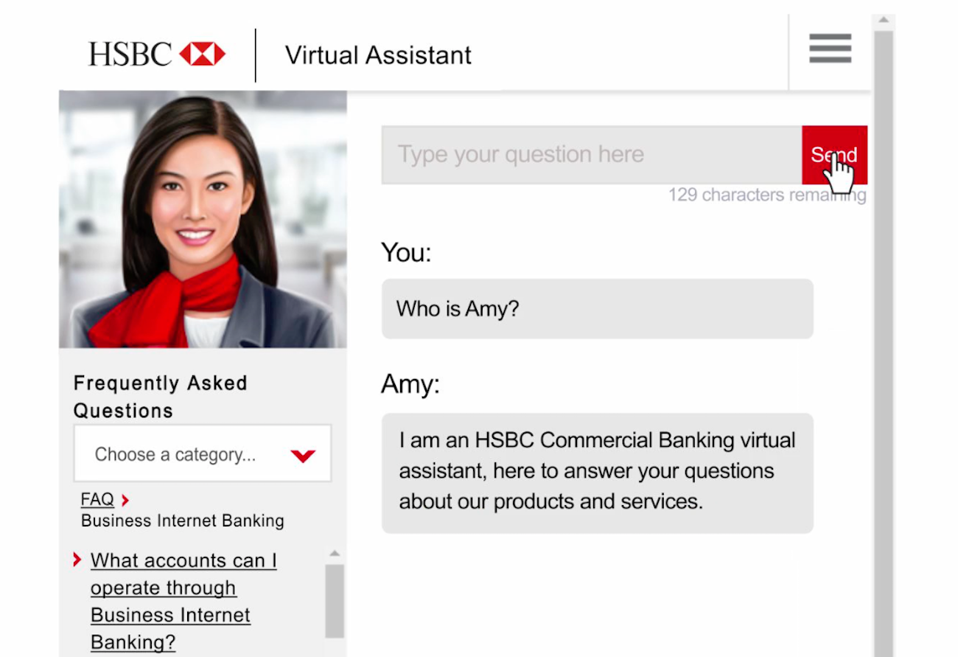

- Deploy AI-driven virtual assistants like HSBC's "Amy" to provide your customers with 24/7 support. These chatbots can significantly reduce wait times and improve customer satisfaction by providing instant, personalized responses to inquiries. Investing in natural language processing technology will make these interactions as human-like as possible.

- Explore blockchain technology for secure, rapid transaction capabilities For example, to offer customers speed and security unmatched by traditional banking systems. Santander's blockchain-based payment service is an example to follow.

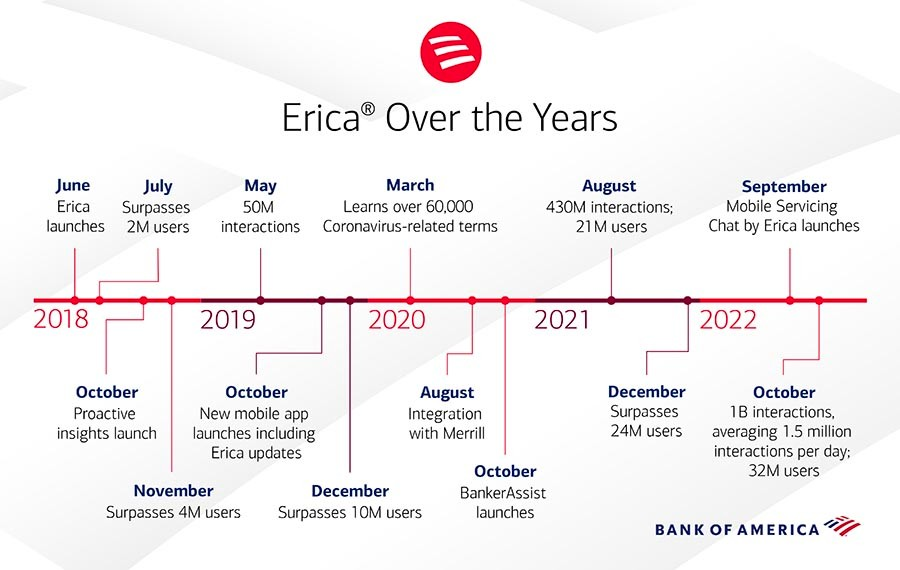

- Machine learning can analyze vast amounts of customer data to offer personalized banking advice and product recommendations. Tools like Bank of America's Erica represent how banks can provide value-added services, transforming the customer relationship from transactional to advisory.

- Consider the potential of digital-only banks for reaching younger, digitally native customers. Neobanks like Monzo or Chime are redefining customer expectations with their user-friendly interfaces and innovative features. Collaborating with or creating your own digital-only branch can attract a new segment of customers looking for a modern banking experience.

In short, technology is not just influencing the banking experience; it's redefining it. From AI to blockchain, the integration of cutting-edge technologies is creating a more intuitive, personalized, and efficient banking world. As we look to the future, the possibilities are as limitless as the technology driving this change, promising a financial landscape that is more accessible, secure, and in tune with the needs of tomorrow's customers.

Way two: Changing customer expectations

The banking landscape is undergoing a seismic shift in how services are delivered and what customers now expect from their banks. Gone are the days when banking was confined to brick-and-mortar branches and limited to 9-to-5 working hours. Today’s customers, empowered by technology and influenced by seamless services in other sectors, demand more.

- Offer bespoke banking experiences based on understanding individual customer needs and preferences. This has to go beyond regular digital banking and customer experience due to customization, including personal interactions at branches or via phone. Tailored advice, recognizing customers by name, and remembering their preferences can make a significant difference. For example, U.S. Bank has been recognized for its personalized customer service approach. By using data analytics, the bank tailors its communication and offers to individual customers' needs, but it’s its emphasis on building personal relationships, especially in wealth management and business banking, that truly stands out. Relationship managers are key to this personalized approach, offering advice and solutions based on a deep understanding of their clients’ unique situations.

- While online services are essential, the in-branch experience still matters for many customers. Simplify and enhance these visits with efficient service, minimal waiting times, and a welcoming atmosphere. Chase Bank offers an example of streamlining in-branch experiences through appointment scheduling and specialized service areas for quick transactions. This not only reduces wait times but also improves the quality of customer interactions with bank staff, making in-branch visits more efficient and enjoyable.

- Beyond digital platforms, host in-person workshops, seminars, and one-on-one financial advisories. These can cover topics from basic budgeting to sophisticated investment strategies. For instance, Wells Fargo has made significant investments in financial education through its “Hands on Banking” program, which offers free online resources for individuals, schools, and communities. This initiative is complemented by in-person seminars and workshops aimed at empowering customers to make informed financial decisions.

- Position yourself as a pillar of the community by sponsoring local events, supporting small businesses, and participating in community development projects. This approach demonstrates a commitment to the local economy and well-being, creating a positive brand image that resonates with customers personally. For example, TD Bank demonstrates strong community engagement through its TD Charitable Foundation, which supports local community, housing, and financial literacy initiatives. Their approach to community engagement extends to sponsoring local events and supporting small businesses, positioning the bank as a community partner rather than just a service provider.

- Actively seek customer feedback on all aspects of the banking experience, from digital tools to in-branch service and community engagement. Use this feedback to make continuous improvements. For instance, Capital One is known for its customer-centric approach, often soliciting feedback through various channels to improve its products and services. The bank uses customer feedback to refine its mobile app and enhance its customer experience. Capital One’s cafés, which blend bank branches with community spaces, also physically manifest its commitment to meeting customer needs through direct engagement and feedback.

Way three: Continuously improve customer experience

Continuously improving the customer experience in the banking and credit union sectors is like embarking on an unending journey of discovery and innovation. In this quest, every touchpoint, service, and product is scrutinized through the customer's lens, ensuring that their needs, expectations, and dreams are met. Here are a few things you can act on to achieve this and even more:

- Create a team focused on customer experience innovation, tasked with identifying and implementing new ways to delight customers. For example, DBS Bank in Singapore has a dedicated innovation group that experiments with new banking ideas and technologies, regularly rolling out improvements that enhance the customer journey and set new industry standards.

- Regularly employ mystery shoppers to provide unbiased feedback on the banking experience across all channels. HSBC uses these insights to identify pain points and opportunities for enhancement. Additionally, mapping out the customer journey in detail helps pinpoint areas where improvements can make a significant impact.

- Encourage employees at all levels to suggest improvements and stay curious about new banking trends and technologies. ING, for instance, promotes an internal culture where feedback is actively sought and valued, leading to incremental innovations that cumulatively enhance the customer experience.

- Collaborate with fintech companies, tech startups, and other industries to bring fresh perspectives and solutions to traditional banking challenges. Santander has partnered with various fintech startups to introduce innovative services and improve the banking experience, from streamlined payment systems to enhanced security features.

- Keep a close eye on competitors and emerging financial services to understand where the market is headed. This not only helps in identifying what customers might expect next but also in spotting opportunities for differentiation. For instance, Ally Bank continuously monitors the competitive landscape to ensure its offerings are not just on par but ahead of what others are doing, particularly regarding customer convenience and digital innovation.

Wrapping up

The key to standing out in banking today is creating outstanding customer experiences. Through examples like U.S. Bank, Chase, and Wells Fargo, we've seen that using technology wisely, tuning into customer needs, and always striving for better service can make a real difference. These strategies meet customer expectations and often exceed them, making customers happy and loyal.

The banks that focus on making their services as customer-friendly as possible are the ones leading the pack. They understand that banking is more than just transactions; it's about making every interaction memorable and easy. Banks can build stronger, lasting relationships by continuously looking for ways to improve and genuinely caring about their customers' needs. This approach doesn't just attract more customers; it turns them into fans who feel valued and understood.