Welcome to the banking industry, where customer centricity rules. In today's fast-paced age, corporate financial institutions are striving to exceed their customers' expectations to stay ahead of the game. To exceed these very expectations, they need to be known. Customer journey mapping not only provides this but also helps to understand experiences as a whole.

That's why the financial services customer journey map is such a powerful tool that helps to create a world where every interaction is seamless and personalized. So we are going to explore the benefits of b2b financial services and discover how those can unlock the full potential of your business.

Contents

Why use journey mapping in b2b financial services?

Corporate banking customer journey mapping can be a valuable tool for banks and financial organizations alike. It helps identify and optimize the various touchpoints their clients encounter throughout their banking experience. Also, banks can gain a better understanding of their clients' needs, preferences, and expectations at each point of interaction.

And then…

- Improve customer satisfaction by identifying and addressing pain points in the journey.

- Increase customer retention by creating a more seamless and positive customer experience in banking.

- Enhance cross-selling and upselling opportunities by understanding customers' banking habits and offering relevant products and services.

- Streamline internal processes and reduce costs by identifying inefficiencies and areas for automation.

- And so much more!

Journey mapping enables corporate banks to provide a more personalized experience to their clients. This helps in improving operational efficiency and driving business growth.

Wanna to learn more about how it works and what insights it can provide? As an example, let's consider a successful publishing company that wants to open a new office in Australia. They want to look into how to open a business account in a local bank. And we will trace their corporate bank client journey, identifying possible problems along the way and listing areas of improvement.

Start with a corporate banking customer journey persona

Creating a customer journey persona for your corporate bank can work like a charm to understand your clients' needs and requirements. This means crafting fictional characters that represent different customer segments. You may have two or more personas, but considering your business goals, you may decide to focus on only some of them (or only one). For instance, those that bring you the most value. By understanding these personas’ motivations, goals, and pain points, you can develop a better customer experience and create more targeted and effective marketing strategies. In our example, there’ll be one key persona.

So how do you go about creating a corporate bank journey persona? Here are a few steps to get you started:

- First, gather as much data as you can on your target audience. Surveys, customer interviews, reviews, and insights from your colleagues—everything will be of use.

- Next, identify patterns in this data that can help you create distinct banking customer segments;

- Once you've done that, it's now time to craft persona profiles that are engaging and authentic. Make sure to add goals, frustrations, motivations, and challenges to create a more concrete representation of your target audience;

- After creating persona profiles, testing and collecting customer feedback can begin. This information can then be added to the profiles. Finally, personas can be integrated into customer experience design, product development, and marketing and sales strategies.

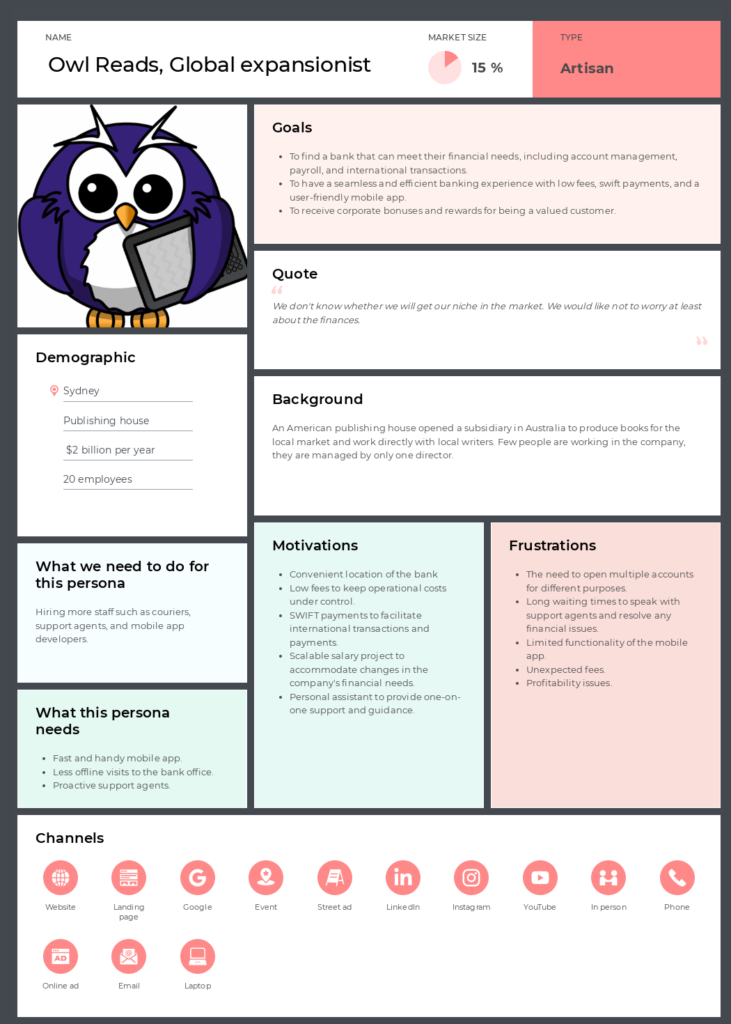

The persona profile may look like this:

And this persona will be the main actor of our corporate banking customer journey map.

Building corporate banking customer journey map

Creating a financial services customer journey map can be both simple and hard at the same time. It requires an understanding of the methodology and a willingness to dig deeper. That's why we aim not just to bring you up to speed and draw a map to the treasure but also to give you a shovel to unearth all the insights about your customers' experience.

So, let's begin by defining the sections of your map and then journey stages. Usually, we do vice versa, you can go both ways.

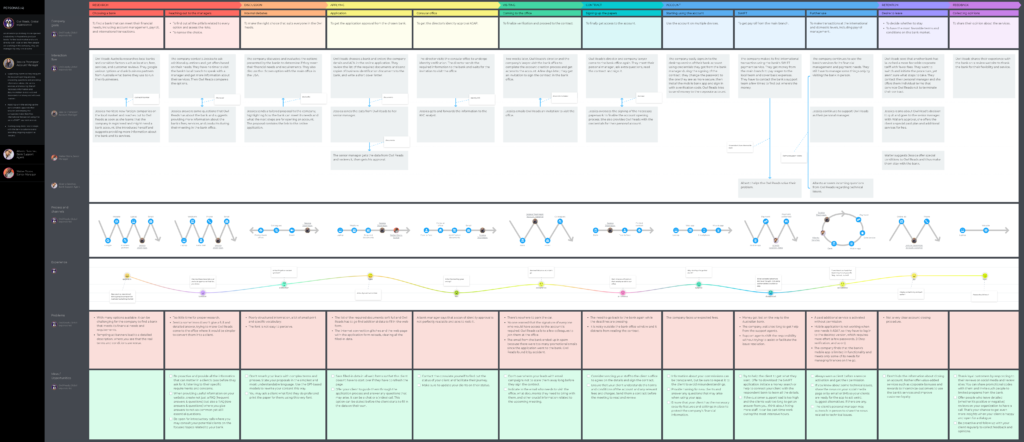

Sections are crucial components of a journey map. Those are determined based on the goal of your project, the degree of desired detail and visualization. To fully reveal a journey, consider including the top journey map layers sections, such as:

- Personas' goals. We have included this section in the Owl Reads map to understand what this persona wants to achieve at each stage and how to help them achieve this;

- Actions. Here we’ll list the specific actions the customer persona takes at different stages of their journey;

- Channels used. This section will contain the communication means/ways used by our customer persona to interact with the bank;

- Emotional journey. A special graph with emojis will help us to capture the customer's feelings, whether positive or negative, experienced during their journey with the bank;

- Problems faced. Here will be the issues the customer encounters while using or researching the bank's services;

- Potential solutions. While here, we will list the potential ways to solve the problems faced by Owl Reads.

To further enrich the corporate banking customer journey map, consider adding:

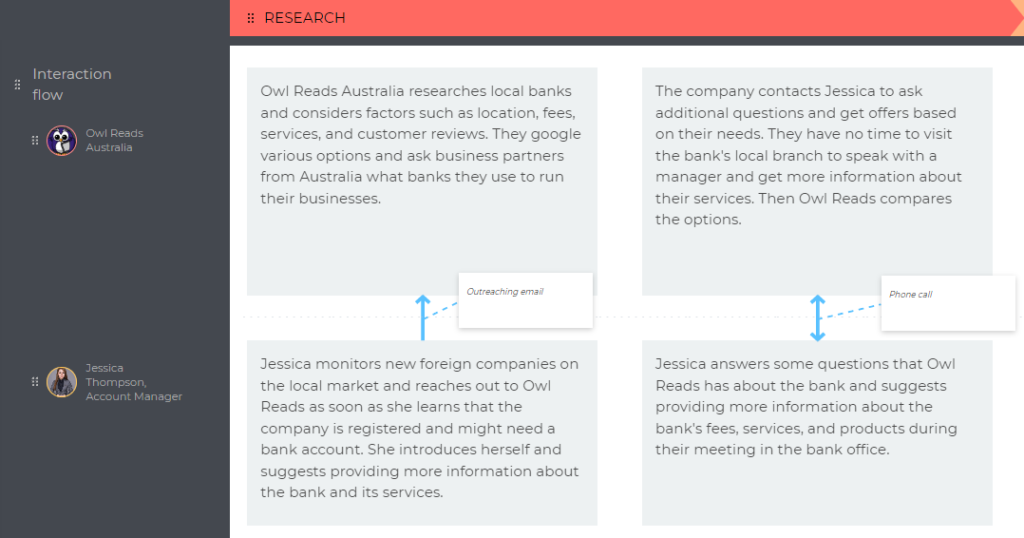

- Interactions between your personas (if you will aim at creating a multipersona map) or your persona and bank employees.

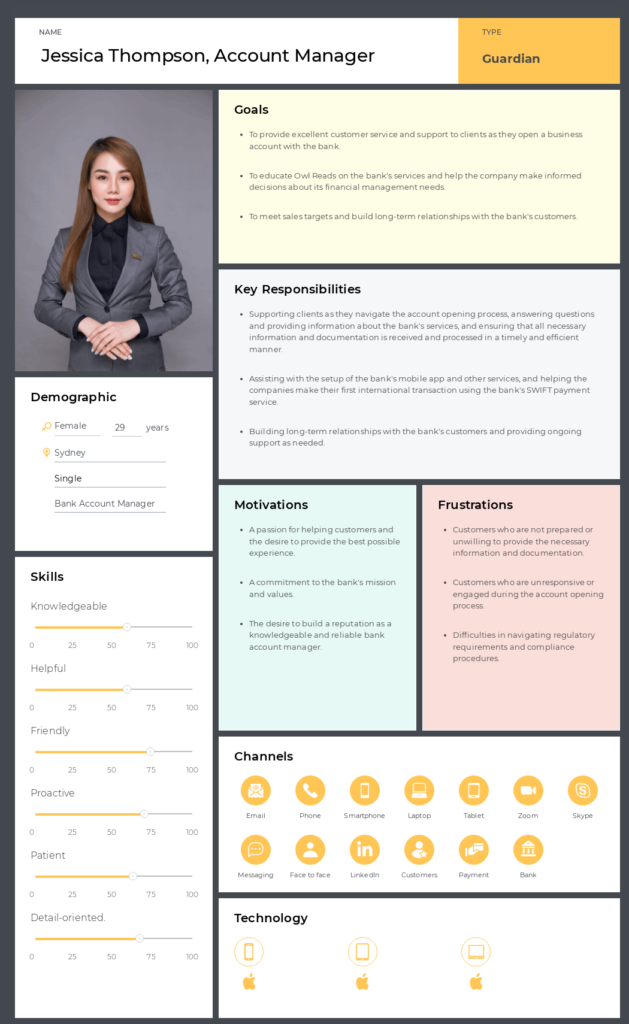

The Owl Reads case: We made more personas to analyze how bank staff interacts with them and the behind-the-scenes procedures. Here's one example:

And here’s how interactions will look in a map:

- The customer's expectations based on their past experiences with another bank or similar services.

- Key performance indicators (KPIs): metrics that track how changes in the customer experience impact business performance.

- Documents such as necessary forms and templates your customer deals with.

- Screenshots from digital banking apps or websites: to highlight good or problematic areas in the customer experience.

UXPressia tip: When mapping in UXPressia, consider connecting Google Forms or/and Analytics, Jira boards, or Slack. Such an integration will automatically update data pieces in your journey maps and alert your team about changes to the journey. This will help keep the map current, solid, and relevant for all team members.

Owl Reads' journey stages

- ‘Research’ that may contain the ‘Choosing a bank’ and ‘Reaching out to the managers’ substages;

- ‘Discussion’;

- ‘Applying’ that may contain the ‘Application’ and ‘Сonsular office’ substages;

- ‘Visiting’;

- ‘Contract’;

- ‘Account’ that may contain the ‘Starting using the account’, ‘SWIFT’, and ‘Further use’ substages;

- ‘Retention’;

- ‘Feedback’.

Ready to look closer at every stage?

Research

When potential customers are in the research stage, they're like a pirate on the high seas, searching for treasure. But, just as a pirate faces obstacles and hazards along the way, these clients can encounter challenges that impact their decision-making process.

Limited information is like sailing through a dense fog, unable to see the treasures within reach. The complexity of the account setup process can feel like navigating treacherous waters, full of dangerous shoals and unexpected storms. The multitude of options available can be like trying to choose the right island to bury your treasure, overwhelmed with indecision.

However, corporate banks can be the reliable compass and guide for these pirate-like clients. The bank can help clients through challenges by providing clear information, simplifying the process, and offering guidance and support. It's like providing a treasure map with marked routes, safe harbors, and valuable clues to help the clients uncover the riches they seek.

So, set your sails and lead your clients to the treasure troves they're searching for. By providing support and guidance, you'll help them conquer their obstacles and find the optimal solution for their business.

The Owl Reads case: the publishing house has very little time to make a decision while the bank manager is slow to provide details. This can be a recipe for frustration and uncertainty, but we've got a solution.

As a bank, you can be proactive and provide your clients with plenty of information ahead of time. Think of it as 'meeting them halfway', so that the client can do their own research and make informed decisions.

So, take the initiative and provide detailed information regarding your organizations, services, requirements, etc. Improve content on your website, fill your Help Center with step-by-step guides, and don’t forget about the social media pages.

By providing a wealth of knowledge to your clients, you'll not only help them make decisions more efficiently, but also give them the impression that you're always available and dependable, even in a pinch.

Discussion

The 'Discussion' stage is like a high-stakes game of chess, where potential clients carefully consider their moves and assess bank benefits. It's a complex and time-consuming process, requiring a sharp eye and a strategic mind to determine the right bank partner.

But, just like a chess game, the sheer amount of information can be overwhelming, making it difficult to distinguish between different banks and their respective offerings.

To make the process easier, the bank can be like personal shopping assistants, providing clients with clear and comprehensive information about your offerings and helping them navigate their options.

But, it's not just about the suit. It's about building a lasting relationship with the client. Like a trusted friend who's always there to offer insights, guidance, and support. You can become a partner in your client's business, working together to achieve success, at such an early stage of your joint journey.

The Owl Reads case: the publishing house needs to agree on a bank with their main office in the USA. But the offer from the bank is a hot mess, and the font is giving them a headache.

Now, some may say that the font choice is irrelevant and that the document's official nature doesn't require a designer-quality presentation. But, my friend, this is where you can stand out among the competition and prevent potential barriers from arising.

By organizing your information like a well-choreographed dance, you can guide your clients' attention and make the information easy to follow. Use bullet points, tables, and other formatting techniques to make the data visually appealing and engaging. And just like a leading actor on stage, your font choice can make or break the performance. Make it easier for your clients to read and understand the information you provide.

Applying

The 'Applying' stage is like the final lap of a relay race. Here, potential clients hand over the baton to the bank and provide the necessary data and documents required to cross the finish line. The bank acts as a vigilant referee. They carefully review the application, verify the client's identity and the legitimacy of their business. They do it all while ensuring a smooth and successful account opening process.

In the B2B context, the application stage can feel like a high-stakes game of Jenga, where businesses must carefully balance their transaction volumes, ownership structures, and regulatory compliance requirements to avoid toppling the tower. B2B clients often face complex challenges in providing accurate and up-to-date documentation required for regulatory compliance purposes, which can lead to delays or complications in the verification process.

To solve these challenges, a bank can provide tailored guidance and support to help clients navigate the application process. This might include the provision of a dedicated account manager or specialist team to manage the account-opening process and provide expert guidance around regulatory procedures.

Providing online tools and platforms that enable your clients to submit their applications and documents digitally. It can reduce the need for manual processing and speed up the account-opening process.

Finally, banks can offer education and training sessions to ensure that B2B banking clients are aware of regulatory compliance requirements and understand the importance of timely and accurate documentation submission. Those can be live demos, online courses, or offline meetings.

The Owl Reads case: As a fledgling organization taking its first steps in a foreign land, Owl Reads found itself navigating unfamiliar terrain when attempting to open an account in Australia. They submitted what they thought were all the necessary documents. However, the bank didn't include some essential requirements on their website, assuming customers would already know. To add to their woes, they were informed that their director needed to visit the Consular office in order to validate their identity.

In such cases, we recommend providing a comprehensive list of all required documents and verifications, as each client's background and circumstances may differ. To make it easier for your clients, you can get verification information from the Consular office for them and keep them informed about their status.

Visiting

The 'Visiting' stage is like a grand entrance at a gala event. It's a time when b2b banking clients get to strut their stuff, meet and greet the bank's staff, and put the final touches on a partnership that promises to be long-lasting and successful.

During this stage, the bank staff shows their clients the lay of the land, introduces them to the people they will work with, and invites them to take a closer look at what they have to offer.

However, like a fancy soiree, there can be unexpected surprises that guests might not anticipate. For instance, legal jargon can confuse clients. Or they can be unsure about how the bank's procedures work. Bank staff should be friendly and make their clients feel comfortable. Just provide a well-planned solution to any issues they may have, reassuring clients' decision to partner with you.

To maintain good customer relationships, banks should be transparent, handle sensitive information carefully, and listen to customers' questions and concerns. Doing so will ensure clients feel happy and confident, leading to a successful partnership.

The Owl Reads case: It all started with the invite email getting caught in their SPAM folder, and no one from the bank followed up to confirm if the meeting date was okay. Then Owl Reads encountered some difficulties during their visit to the bank. Firstly, parking was somewhat of a hassle. To add to that, they were unaware that each person who requires access to the corporate account needed to provide their signature. As a result, they had to wait until other Owl Reads employees arrived.

To prevent the situation, use several channels to invite clients and get confirmation from them beforehand. And ensure your clients are well-informed about all the details and nuances of the meeting before they arrive.

Contract

The 'Contract' stage is like sealing a deal with a handshake. But in the Corporate banking customer journey case, it's with a signature. Here, the client has already done their homework and chosen the bank as their financial partner. They provided the documents and passed verifications. However, the contract can sometimes resemble a maze of legal jargon and technical terms, causing confusion and frustration for the client.

To avoid this maze, make sure the contract is clear and concise and outlines all the terms and conditions of the agreement. You may also provide a summary of the agreement that highlights the key terms and conditions. And be transparent with the client about any fees, interest rates, or charges that may come as a surprise later on.

The Owl Reads case: When Owl Reads arrived to sign the papers, the air conditioner was broken in the room and they had to open the window. It was very noisy outside, thus hard to concentrate and comprehend the words on paper.

To help clients concentrate on the contract details without noise distractions, you may send a representative to their office, which saves time on travel and ensures all necessary employees are present for signing. Sending the contract beforehand allows the client to review the terms before the meeting. This will speed up the signing process and free up time for other important tasks.

Account

At the 'Account' stage, the B2B client must tap into the full potential of their personal bank account to manage their finances effectively. Their journey here is like the bloodstream that keeps the business running smoothly by facilitating regular transactions such as fund transfers, cash management, and bill payments, which are the life force of their company.

However, like any machinery, there are potential issues needed to be addressed. Banks should use advanced safety measures including encryption and authorization to prevent unauthorized access and fraud. Alerts and multi-factor authentication serve as early warning systems to notify account holders of any suspicious activity, like an ECG that tracks heart activity.

The Owl Reads case: Picture this, Owl Reads had a bit of a scare when their SWIFT payment went missing on its way from the USA to Australia. Unfortunately, their personal manager and customer support left them feeling stranded and helpless. Thankfully, everything ended up alright, but it could have been handled better.

To prevent this kind of situation in the future, we suggest recommending your clients the option to install the SWIFT application. Helping clients learn about how to search for money or connecting them with the bank can reduce their stress and anxiety.

If you find that your customer support team is struggling to keep up with the load, don't wait until it's too late to hire more staff. Consider bringing on part-time help during peak hours to make sure your clients don't have to wait too long for answers.

At the end of the day, your clients trust you with their financial transactions, and it's up to you to make sure they feel supported in every step of the process. By being proactive and offering solutions before problems arise, you can build a stronger and more loyal client base.

Retention

The 'Retention' stage can be likened to a delicate dance. It’s when the client is considering switching banks, and the bank needs to lead with graceful steps to keep them from leaving. The goal is to create a rhythm that resonates with the client, addressing any concerns and offering them better solutions than what other banks can provide.

In a B2B setting, the dance becomes even more complex, like a tango between two skilled partners. You have to intimately understand the client's business operations and financial goals, moving in sync to identify areas where you can offer value-added services.

However, one misstep could cause the dance to fall apart. B2B clients often face a lack of personalized service, like a clumsy partner who steps on their toes. So you need to offer bespoke solutions tailored to the specific needs of your clients with grace and finesse.

Communication is also crucial in this dance. The client needs to feel connected to their bank, like they are moving together in perfect harmony. So make sure to establish clear lines of communication.

To retain B2B clients, you need to deliver a high level of service that is tailored, personalized, and responsive. Think about investing in technology, resources, and training to ensure your staff can deliver an exceptional customer experience. Or consider introduction of special terms for getting a banking loan. By doing so, you can create a dance that flows smoothly, building strong relationships with their clients and retaining them for the long term.

The Owl Reads case: Upon discovering another bank had launched a better corporate tariff with fewer fees, Owl Reads was keen to switch over. However, they were unsure of the process and reached out to their personal manager for guidance. To their surprise, their manager offered them personalized terms that proved to be more beneficial than the new tariff. This left Owl Reads feeling satisfied and content with their current bank.

But what if the bank had taken a more proactive approach? What if they had reached out to Owl Reads first and offered them the better tariff before they had even heard about it? This simple act of taking the initiative would have made Owl Reads feel valued and appreciated.

To remain competitive in the market, you should continuously review and update your tariffs. Offering personalized and flexible terms is also vital for retaining customers. A transparent and seamless switching process, along with incentives for loyalty, would go a long way in keeping customers happy and content.

Ultimately, clear communication and responsiveness are key. By providing exceptional service and anticipating the needs of customers, you can prevent them from seeking better deals elsewhere.

Feedback

The 'Feedback' stage is like a compass that guides the bank towards the right direction. It's the stage where the clients share their opinions, and the bank listens carefully to understand their needs and expectations. Just like a sailor navigating through the sea, the bank needs to ensure that it has a clear view of the feedback to avoid any obstacles and reach its destination as it may contain useful insights regarding the product, service, or customer experience.

Yet, B2B clients can be like hidden reefs that can be challenging to navigate. Without a proper feedback mechanism, the bank may hit these reefs and damage the relationship with the client. Therefore, you need a robust radar system that can detect any feedback signals from the B2B clients and act upon them promptly.

This radar system can involve regular surveys, feedback forms, and scheduled meetings with the clients. The feedback collected should be analyzed carefully to identify any areas that need improvement and enhance the bank's services and products' overall customer experience.

The Owl Reads case: Owl Reads landed on a review website to express their gratitude towards their bank for their remarkable flexibility and outstanding service. What's truly astonishing is the fact that their experience was quite smooth at this stage. Kudos to you, our imaginary bank! Yet, we’d recommend reaching out to this satisfied client to delve deeper into their experiences and opinions.

After all, it's important to recognize that valuable lessons can come from both positive and negative experiences. While negative experiences can teach us what to avoid, positive ones can highlight what we should highlight to make the overall journey smoother. So don't overlook the power of positive experiences—they may hold the key to unlocking your full potential.

Corporate banking customer journey map template

Well, well, well, what a ride it has been! So many twists and turns, potential roadblocks, and opportunities for takeoff. If we were to summarize the happenings at Owl Reads, we'd end up with a map that looks something like this:

Feel free to draw inspiration from this as the basis for your own corporate banking customer journey map.

Wrapping up

In today's cutthroat corporate banking sector, where digital transformation never stops and customers have numerous options, a smooth and seamless customer journey is essential to stand out and gain an edge over the competition. To ensure customer satisfaction, you may create an end-to-end customer journey map in finance. Feel free to use our ready-to-go customer journeys and examples of persona profiles to do it faster. The map that will serve as a bridge, leading you to happy customers. Although it may seem like a daunting task, the effort you put into will certainly pay off in the end.