This article is based on the second part of the event with Rod Netterfield and Jodie Fielding of Humind, where Jodie shared a case study about improving the financial services customer experience.

How do you make understanding and improving customer experience successful in a financial services company? By taking advantage of end-to-end experience mapping and ensuring the contribution and engagement of employees at every stage of the journey.

Learn how to organize the entire process from getting executive buy-in to implementing changes from a case study of a financial services customer experience mapping shared by Jodie Fielding, Chief Delivery Officer at Influx and Director at Humind, at our recent event.

Contents

About the company

The financial services company was ten years old, positioned as a challenger brand on the market and growing rapidly. The company's success was built on a strong customer-centered focus and data-driven decision-making.

The state of the customer’s experience

The customer experience challenge the company faced was a result of its rapid success. Growing fast and adding new services and products created a need to make service, product, and process design decisions quickly. There was never time to look back retrospectively to understand what kind of experience these decisions collectively created over the years. The pace of growth and product diversification meant always looking forward. But there still was some poor experience happening throughout the end-to-end product lifecycle for customers.

The CX challenge was not obvious in the data: the customer retention rate and overall transactional NPS were good. However, customer feedback and customer research indicated that the frontline teams mostly drove the success. Those were literally superheroes patching over bad processes, rules, systems, and lacking communication, compensating for a poorly designed customer experience.

On the way to a better customer experience

Jodie felt the company needed to do something around the end-to-end customer journey, but cross-organization collaboration was traditionally low. It needed commitment from the top to spark the need for collaboration on improving the customer experience. Luckily, she didn’t have to wait too long for the perfect moment to ignite the focus.

Jumping at the chance

Two things came together, paving the way for reviewing the end-to-end customer experience.

Firstly, a more detailed analysis and awareness of customer feedback highlighted the inconsistencies between its divisions: the experience they created in one part differed from the one in another. The organization didn’t know where to start in fixing those and where to get enough momentum. At the same time, there was a great commitment from all the teams working on improving the experience, but it was very siloed. So the question arose: how to look at the bigger picture of what the end-to-end product cycle was creating as an experience?

The second key shift was that the company’s CEO got interested in the written communication they were sending to customers. He had personally dealt with a complaint from a customer, which ignited a lot of conversations. The executive team requested an inventory of every interaction and customer contact as they set the goal to improve communication. The opportunity arose: how to leverage executive buy-in on a specific communication problem to understand the broader challenge of the end-to-end experience?

Choosing the approach and instruments

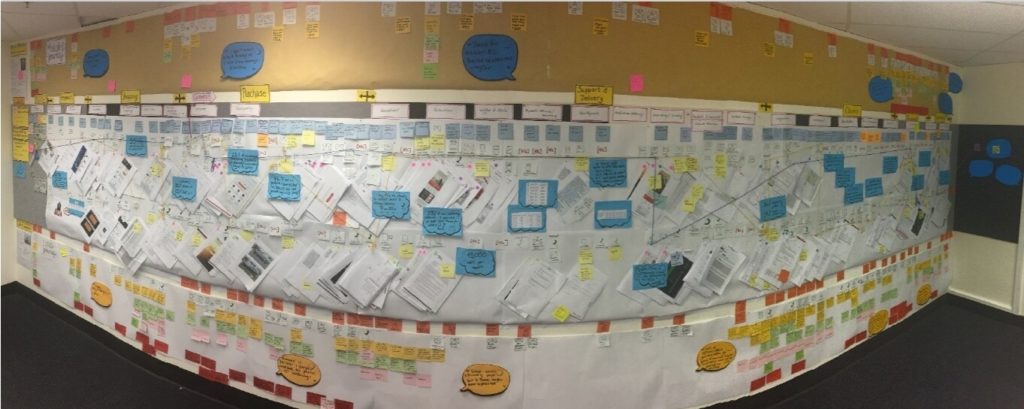

Given the organization’s maturity and the novelty of the customer journey mapping concept to the executive team, the decision was made to initially not build a traditional customer journey map. Rather, to opt for something familiar first to show value quickly. It was a customer interaction map, mapping all the interactions in the product lifecycle across various channels. Another decision was to build this the old-school way: a physical map in a dedicated room where all the information, samples, and insights were presented as a hard copy of the map.

The CX team started by mapping the key stages of the product life cycle and then brought an abundance of information and data to their map.

“The advantage was that the company was data-rich, and we could bring some of that insight to the interaction map.”

The team plotted and collected every proof of interaction the organization had with the customer along each channel: voice, physical emails, and marketing materials. The team printed and laid out all the information against the key stages and then overlaid key statistics.

Pretty soon, they revealed one of the problems: the volume and inconsistency in some of the interactions with the customers.

As a final step in the mapping, the team went about defining personas and mapped two major ones along the interactions. This last step created customer journeys on top of the interaction map and allowed for greater depth of understanding and insight.

Engaging the teams for co-creation

The CX team had some external support, which made it easy for them to get momentum and progress quickly. They intentionally kept everyone out of the mapping room, making other people in the company become really curious and building the hype around it.

The executive team was the first to get a tour of the interaction map while it was still in development. This also provided a positive validation step for the CX team to continue.

“They gave great positive feedback. So we hit the mark on raising their awareness and giving insight into what it felt like to be a customer. And they asked us to keep going.”

The executive team became strongly engaged in the process, highlighting and filling in data gaps. They became interested in ensuring their teams contributed, turning the process into a competition between the executives to check all their interactions, processes, and data were on the wall.

Next, the CX team started to invite individuals and teams to come for a walkthrough of the map to help identify gaps in their area, spot opportunities for improvement, and get feedback and insights on the action.

Eventually, as the map neared completion, the walkthrough of the map became open to everyone in the company. As a result, over 40% of the company employees, from HR and IT to customer services teams, took a mapping “room tour”. Some employees took multiple walkthroughs to see the story change as the team worked on updating the map iteratively. In some instances, quick win improvements were made.

“The customers' experience story evolved, and it helped reinforce the message that there were opportunities for improvements and that by working collaboratively, quick wins could be identified and actioned. People got more and more curious on every trip, looking for ways to improve.”

Implementing results

Being part of a tour of the interactions and ultimately the journey map, employees could see the problems in their own area. This created momentum for them to make quick improvements. The CX team saw improvements made immediately by teams and updated the map accordingly.

Using feedback collected during the walkthroughs, the CX team defined two focus areas for improvement:

- Cross-functional quick wins as people had been making changes based on what they saw and learned during the tours. These things required some coordination and collaboration.

- 15 major projects driving bigger change across the entire organization. This eventually evolved into a two-year program of experience improvement.

Another impressive result was that the company started to recognize the need to be intentional with the end-to-end customer experience they were creating. There was cross-organizational support for creating one view of what a great experience looked and felt like. To capture and articulate this, the team crafted CX principles that were rolled out across the organization.

The last step was designing a clear strategy on what the company wanted to create with the experience. It was a long-term investment and had a long-lasting positive impact.

Lessons learned: major case study takeaways

There are three big things for you to take away from this case study:

- Get buy-in and engagement from the top.

Without that commitment, everything gets a lot tougher. Sometimes you need to wait weeks, months to get the commitment from key stakeholders before you start anything.

- You don't have to follow the rules of customer experience.

You don’t always need to start with a journey map, especially if your organization is not ready for it. You need to recognize their maturity in CX. So break the rules, trust your instinct, and adapt the process to your organization.

- Cultivating change requires teamwork and a lot of storytelling.

You need the whole team involved to drive big changes to your customer experience. In this financial services case study, the company had a good commitment at the ground level, but cross-functional commitments to the customer were missing. Getting there required lots of storytelling and making everyone understand the stories of your customer from their perspective.

The recording

Watch the full recording of our event with Rod and Jodie for a lively conversation, even more details and examples from the case, and a Q&A session.

Or check out the post on Rod's student journey map case if you prefer reading.

Jodie Fielding is the Chief Delivery Officer at Influx and co-founder and Director at Humind. Jodie has a diverse career across financial services, health insurance, government, IT, and higher education leading major change initiatives and projects, service and sales operations, and specialist customer experience functions.

Love the old-school approach. It’s always handy to have a digital copy of the map as well though. Something that huge that’s pinned to a wall is not very flexible. But definitely a great way to spark interest among colleagues unless most of the organization is not working remotely.